THE END OF CHEAP OIL

by Colin J. Campbell and Jean H.

Laherrère,

Scientific American, March 1998

|

Derricks bristling above the Los Angeles basin.

In 1973 and 1979 a pair of sudden price increases rudely awakened the industrial world to its dependence on cheap crude oil. Prices first tripled in response to an Arab embargo and then nearly doubled again when Iran dethroned its Shah, sending the major economies sputtering into recession. Many analysts warned that these crises proved that the world would soon run out of oil. Yet they were wrong.

Their dire predictions were emotional and political reactions; even at the time, oil experts knew that they had no scientific basis. Just a few years earlier oil explorers had discovered enormous new oil provinces on the north slope of Alaska and below the North Sea off the coast of Europe. By 1973 the world had consumed, according to many experts’ best estimates, only about one eighth of its endowment of readily accessible crude oil (so-called conventional oil). The five Middle Eastern members of the Organization of Petroleum Exporting Countries (OPEC) were able to hike prices not because oil was growing scarce but because they had managed to corner 36 percent of the market. Later, when demand sagged, and the flow of fresh Alaskan and North Sea oil weakened OPEC’s economic stranglehold, prices collapsed.

The next oil crunch will not be so temporary. Our analysis of the discovery and production of oil fields around the world suggests that within the next decade, the supply of conventional oil will be unable to keep up with demand. This conclusion contradicts the picture one gets from oil industry reports, which boasted of 1,020 billion barrels of oil (Gbo) in "Proved" reserves at the start of 1998. Dividing that figure by the current production rate of about 23.6 Gbo a year might suggest that crude oil could remain plentiful and cheap for 43 more years—probably longer, because official charts show reserves growing.

Unfortunately, this appraisal makes three critical errors. First, it relies on distorted estimates of reserves. A second mistake is to pretend that production will remain constant. Third and most important, conventional wisdom erroneously assumes that the last bucket of oil can be pumped from the ground just as quickly as the barrels of oil gushing from wells today. In fact, the rate at which any well—or any country—can produce oil always rises to a maximum and then, when about half the oil is gone, begins falling gradually back to zero.

From an economic perspective, when the world runs completely out of oil is thus not directly relevant: what matters is when production begins to taper off. Beyond that point, prices will rise unless demand declines commensurately.

Using several different techniques to estimate the current reserves of conventional oil and the amount still left to be discovered, we conclude that the decline will begin before 2010.

|

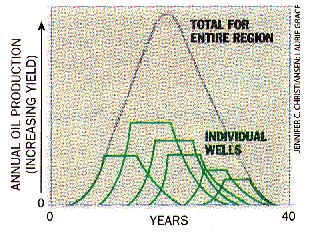

FLOW OF OIL starts to fall from any large region when about half the crude is gone. Adding the output of fields of various sizes and ages (green curves above) usually yields a bell-shaped production curve for the region as a whole. M. King Hubbert, a geologist with Shell Oil, exploited this fact in 1956 to predict correctly that oil from the lower 48 American states would peak around 1969.

We have spent most of our careers exploring for oil, studying reserve figures and estimating the amount of oil left to discover, first while employed at major oil companies and later as independent consultants. Over the years, we have come to appreciate that the relevant statistics are far more complicated than they first appear.

Consider, for example, three vital numbers needed to project future oil production. The first is the tally of how much oil has been extracted to date, a figure known as cumulative production. The second is an estimate of reserves, the amount that companies can pump out of known oil fields before having to abandon them. Finally, one must have an educated guess at the quantity of conventional oil that remains to be discovered and exploited. Together they add up to ultimate recovery, the total number of barrels that will have been extracted when production ceases many decades from now.

The obvious way to gather these numbers is to look them up in any of several publications. That approach works well enough for cumulative production statistics because companies meter the oil as it flows from their wells. The record of production is not perfect (for example, the two billion barrels of Kuwaiti oil wastefully burned by Iraq in 1991 is usually not included in official statistics), but errors are relatively easy to spot and rectify. Most experts agree that the industry had removed just over 800 Gbo from the earth at the end of 1997.

Getting good estimates of reserves is much harder, however. Almost all the publicly available statistics are taken from surveys conducted by the Oil and Gas Journal and World Oil. Each year these two trade journals query oil firms and governments around the world. They then publish whatever production and reserve numbers they receive but are not able to verify them.

The results, which are often accepted uncritically, contain systematic errors. For one, many of the reported figures are unrealistic. Estimating reserves is an inexact science to begin with, so petroleum engineers assign a probability to their assessments. For example, if, as geologists estimate, there is a 90 percent chance that the Oseberg field in Norway contains 700 million barrels of recoverable oil but only a 10 percent chance that it will yield 2,500 million more barrels, then the lower figure should be cited as the so-called P90 estimate (P90 for "probability 90 percent") and the higher as the P10 reserves.

In practice, companies and countries are often deliberately vague about the likelihood of the reserves they report, preferring instead to publicize whichever figure, within a P10 to P90 range, best suits them. Exaggerated estimates can, for instance, raise the price of an oil company’s stock.

|

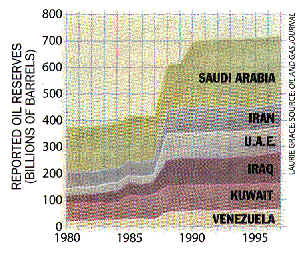

SUSPICIOUS JUMP in reserves reported by six OPEC members added 300 billion barrels of oil to official reserve tallies yet followed no major discovery of new fields.

The members of OPEC have faced an even greater temptation to inflate their reports because the higher their reserves, the more oil they are allowed to export. National companies, which have exclusive oil rights in the main OPEC countries, need not (and do not) release detailed statistics on each field that could be used to verify the country’s total reserves. There is thus good reason to suspect that when, during the late 1980s, six of the 11 OPEC nations increased their reserve figures by colossal amounts, ranging from 42 to 197 percent, they did so only to boost their export quotas.

Previous OPEC estimates, inherited from private companies before governments took them over, had probably been conservative, P90 numbers. So some upward revision was warranted. But no major new discoveries or technological breakthroughs justified the addition of a staggering 287 Gbo. That increase is more than all the oil ever discovered in the U.S.—plus 40 percent. Non-OPEC countries, of course, are not above fudging their numbers either: 59 nations stated in 1997 that their reserves were unchanged from 1996. Because reserves naturally drop as old fields are drained and jump when new fields are discovered, perfectly stable numbers year after year are implausible.

|

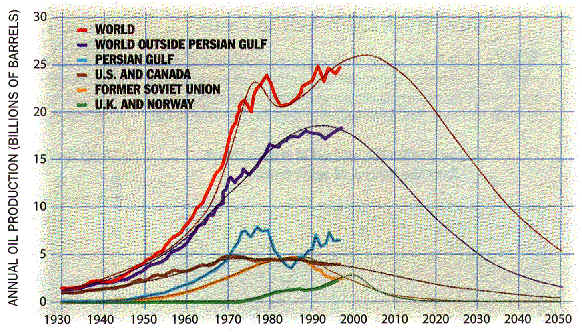

GLOBAL PRODUCTION OF OIL both conventional and unconventional (red), recovered after falling in 1973 and 11979. But a more permanent decline is less than 10 years away, according to the authors’ model, based in part on multiple Hubbert curves (lighter lines). U.S. and Canadian oil (brown) topped out in 1972; production in the former Soviet Union (yellow) has fallen 45 percent since 1987. A crest in the oil produced outside the Persian Gulf region (purple) now appears imminent.

Another source of systematic error in the commonly accepted statistics is that the definition of reserves varies widely from region to region. In the U.S., the Securities and Exchange Commission allows companies to call reserves "proved" only if the oil lies near a producing well and there is "reasonable certainty" that it can be recovered profitably at current oil prices, using existing technology. So a proved reserve estimate in the U.S. is roughly equal to a P90 estimate.

Regulators in most other countries do not enforce particular oil-reserve definitions. For many years, the former Soviet countries have routinely released wildly optimistic figures—essentially P10 reserves. Yet analysts have often misinterpreted these as estimates of "proved" reserves. World Oil reckoned reserves in the former Soviet Union amounted to 190 Gbo in 1996, whereas the Oil and Gas Journal put the number at 57 Gbo. This large discrepancy shows just how elastic these numbers can be.

Using only P90 estimates is not the answer, because adding what is 90 percent likely for each field, as is done in the U.S., does not in fact yield what is 90 percent likely for a country or the entire planet. On the contrary, summing many P90 reserve estimates always understates the amount of proved oil in a region. The only correct way to total up reserve numbers is to add the mean, or average, estimates of oil in each field. In practice, the median estimate, often called "proved and probable," or P50 reserves, is more widely used and is good enough. The P50 value is the number of barrels of oil that are as likely as not to come out of a well during its lifetime, assuming prices remain within a limited range. Errors in P50 estimates tend to cancel one another out.

We were able to work around many of the problems plaguing estimates of conventional reserves by using a large body of statistics maintained by Petroconsultants in Geneva. This information, assembled over 40 years from myriad sources, covers some 18,000 oil fields worldwide. It, too, contains some dubious reports, but we did our best to correct these sporadic errors.

According to our calculations, the world had at the end of 1996 approximately 850 Gbo of conventional oil in P50 reserves—substantially less than the 1,019 Gbo reported in the Oil and Gas Journal and the 1,160 Gbo estimated by World Oil. The difference is actually greater than it appears because our value represents the amount most likely to come out of known oil fields, whereas the larger number is supposedly a cautious estimate of proved reserves.

For the purposes of calculating when oil production will crest, even more critical than the size of the world’s reserves is the size of ultimate recovery—all the cheap oil there is to be had. In order to estimate that, we need to know whether, and how fast, reserves are moving up or down. It is here that the official statistics become dangerously misleading.

|

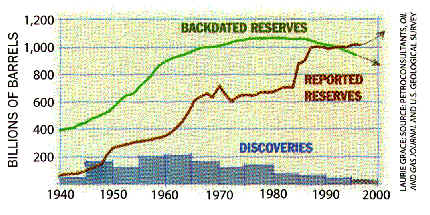

GROWTH IN OIL RESERVES since 1980 is an illusion caused by belated corrections to oil-field estimates. Backdating the revisions to the year in which the fields were discovered reveals that reserves have been failing because of a steady decline in newfound oil (blue).

According to most accounts, world oil reserves have marched steadily upward over the past 20 years. Extending that apparent trend into the future, one could easily conclude, as the U.S. Energy Information Administration has, that oil production will continue to rise unhindered for decades to come, increasing almost two thirds by 2020.

Such growth is an illusion. About 80 percent of the oil produced today flows from fields that were found before 1973, and the great majority of them are declining. In the 1990s oil companies have discovered an average of seven Gbo a year; last year they drained more than three times as much. Yet official figures indicated that proved reserves did not fall by 16 Gbo, as one would expect rather they expanded by 11 Gbo. One reason is that several dozen governments opted not to report declines in their reserves, perhaps to enhance their political cachet and their ability to obtain loans. A more important cause of the expansion lies in revisions: oil companies replaced earlier estimates of the reserves left in many fields with higher numbers. For most purposes, such amendments are harmless, but they seriously distort forecasts extrapolated from published reports.

To judge accurately how much oil explorers will uncover in the future, one has to backdate every revision to the year in which the field was first discovered—not to the year in which a company or country corrected an earlier estimate. Doing so reveals that global discovery peaked in the early 1960s and has been falling steadily ever since. By extending the trend to zero, we can make a good guess at how much oil the industry will ultimately find.

We have used other methods to estimate the ultimate recovery of conventional oil for each country [see box on next two pages], and we calculate that the oil industry will be able to recover only about another 1,000 billion barrels of conventional oil. This number, though great, is little more than the 800 billion barrels that have already been extracted.

It is important to realize that spending more money on oil exploration will not change this situation. After the price of crude hit all-time highs in the early 1980s, explorers developed new technology for finding and recovering oil, and they scoured the world for new fields. They found few: the discovery rate continued its decline uninterrupted. There is only so much crude oil in the world, and the industry has found about 90 percent of it.

Predicting when oil production will stop rising is relatively straightforward once one has a good estimate of how much oil there is left to produce. We simply apply a refinement of a technique first published in 1956 by M. King Hubbert. Hubbert observed that in any large region, unrestrained extraction of a finite resource rises along a bellshaped curve that peaks when about half the resource is gone. To demonstrate his theory, Hubbert fitted a bell curve to production statistics and projected that crude oil production in the lower 48 U.S. states would rise for 13 more years, then crest in 1969, give or take a year. He was right: production peaked in 1970 and has continued to follow Hubbert curves with only minor deviations. The flow of oil from several other regions, such as the former Soviet Union and the collection of all oil producers outside the Middle East, also follows Hubbert curves quite faithfully.

The global picture is more complicated, because the Middle East members of OPEC deliberately reined back their oil exports in the 1970s, while other nations continued producing at full capacity. Our analysis reveals that a number of the largest producers, including Norway and the U.K., will reach their peaks around the turn of the millennium unless they sharply curtail production. By 2002 or so the world will rely on Middle East nations, particularly five near the Persian Gulf (Iran, Iraq, Kuwait, Saudi Arabia and the United Arab Emirates), to fill in the gap between dwindling supply and growing demand. But once approximately 900 Gbo have been consumed, production must soon begin to fall. Barring a global recession, it seems most likely that world production of conventional oil will peak during the first decade of the 21st century.

Perhaps surprisingly, that prediction does not shift much even if our estimates are a few hundred billion barrels high or low. Craig Bond Hatfield of the University of Toledo, for example, has conducted his own analysis based on a 1991 estimate by the U.S. Geological Survey of 1,550 Gbo remaining—55 percent higher than our figure. Yet he similarly concludes that the world will hit maximum oil production within the next 15 years. John D. Edwards of the University of Colorado published last August one of the most optimistic recent estimates of oil remaining: 2,036 Gbo. (Edwards concedes that the industry has only a 5 percent chance of attaining that very high goal.) Even so, his calculations suggest that conventional oil will top out in 2020.

Factors other than major economic changes could speed or delay the point at which oil production begins to decline. Three in particular have often led economists and academic geologists to dismiss concerns about future oil production with naive optimism.

First, some argue, huge deposits of oil may lie undetected in far-off corners of the globe. In fact, that is very unlikely. Exploration has pushed the frontiers back so far that only extremely deep water and polar regions remain to be fully tested, and even their prospects are now reasonably well understood. Theoretical advances in geochemistry and geophysics have made it possible to map productive and prospective fields with impressive accuracy. As a result, large tracts can be condemned as barren. Much of the deepwater realm, for example, has been shown to be absolutely nonprospective for geologic reasons.

What about the much touted Caspian Sea deposits? Our models project that oil production from that region will grow until around 2010. We agree with analysts at the USGS World Oil Assessment program and elsewhere who rank the total resources there as roughly equivalent to those of the North Sea that is, perhaps 50 Gbo but certainly not several hundreds of billions as sometimes reported in the media.

A second common rejoinder is that new technologies have steadily increased the fraction of oil that can be recovered from fields in a basin—the so-called recovery factor. In the 1960s oil companies assumed as a rule of thumb that only 30 percent of the oil in a field was typically recoverable; now they bank on an average of 40 or 50 percent. That progress will continue and will extend global reserves for many years to come, the argument runs.

Of course, advanced technologies will buy a bit more time before production starts to fall [see "Oil Production in the 21st Century," by Roger N. Anderson, on page 86]. But most of the apparent improvement in recovery factors is an artifact of reporting. As oil fields grow old, their owners often deploy newer technology to slow their decline. The falloff also allows engineers to gauge the size of the field more accurately and to correct previous underestimation—in particular P90 estimates that by definition were 90 percent likely to be exceeded.

Another reason not to pin too much hope on better recovery is that oil companies routinely count on technological progress when they compute their reserve estimates. In truth, advanced technologies can offer little help in draining the largest basins of oil, those onshore in the Middle East where the oil needs no assistance to gush from the ground.

Last, economists like to point out that the world contains enormous caches of unconventional oil that can substitute for crude oil as soon as the price rises high enough to make them profitable. There is no question that the resources are ample: the Orinoco oil belt in Venezuela has been assessed to contain a staggering 1.2 trillion barrels of the sludge known as heavy oil. Tar sands and shale deposits in Canada and the former Soviet Union may contain the equivalent of more than 300 billion barrels of oil [see "Mining for Oil," by Richard L. George, on page 84]. Theoretically, these unconventional oil reserves could quench the world’s thirst for liquid fuels as conventional oil passes its prime. But the industry will be hard-pressed for the time and money needed to ramp up production of unconventional oil quickly enough

Such substitutes for crude oil might also exact a high environmental price. Tar sands typically emerge from strip mines. Extracting oil from these sands and shales creates air pollution. The Orinoco sludge contains heavy metals and sulfur that must be removed. So governments may restrict these industries from growing as fast as they could. In view of these potential obstacles, our skeptical estimate is that only 700 Gbo will be produced from unconventional reserves over the next 60 years.

Meanwhile global demand for oil is currently rising at more than 2 percent a year. Since 1985, energy use is up about 30 percent in Latin America, 40 percent in Africa and 50 percent in Asia. The Energy Information Administration forecasts that worldwide demand for oil will increase 60 percent (to about 40 Gbo a year) by 2020.

The switch from growth to decline in oil production will thus almost certainly create economic and political tension. Unless alternatives to crude oil quickly prove themselves, the market share of the OPEC states in the Middle East will rise rapidly. Within two years, these nations’ share of the global oil business will pass 30 percent, nearing the level reached during the oil-price shocks of the 1970s. By 2010 their share will quite probably hit 50 percent.

The world could thus see radical increases in oil prices. That alone might be sufficient to curb demand, flattening production for perhaps 10 years. (Demand fell more than 10 percent after the 1979 shock and took 17 years to recover.) But by 2010 or so, many Middle Eastern nations will themselves be past the midpoint. World production will then have to fall.

With sufficient preparation, however, the transition to the post-oil economy need not be traumatic. If advanced methods of producing liquid fuels from natural gas can be made profitable and scaled up quickly, gas could become the next source of transportation fuel [see "Liquid Fuels from Natural Gas," by Safaa A. Fouda, on page 92]. Safer nuclear power, cheaper renewable energy, and oil conservation programs could all help postpone the inevitable decline of conventional oil.

Countries should begin planning and investing now. In November a panel of energy experts appointed by President Bill Clinton strongly urged the administration to increase funding for energy research by $1 billion over the next five years. That is a small step in the right direction, one that must be followed by giant leaps from the private sector.

The world is not running out of oil—at least not yet. What our society does face, and soon, is the end of the abundant and cheap oil on which all industrial nations depend.

How Much Oil is Left to Find?

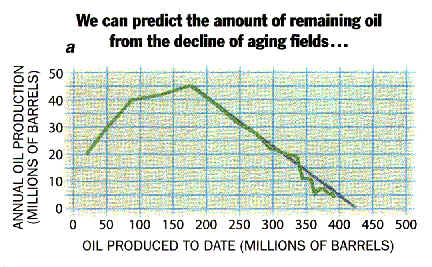

We combined several techniques to conclude

that about 1,000 billion barrels of conventional oil remain to be

produced. First, we extrapolated published production figures for older

oil fields that have begun to decline. The Thistle field off the coast of

Britain, for example, will yield about 420 million barrels (a).

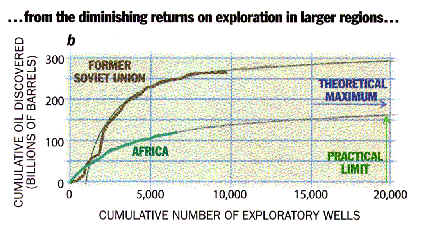

Second, we plotted the amount of oil discovered so far in some regions

against the cumulative number of exploratory wells drilled there. Because

larger fields tend to be found first-they are simply too large to miss-the

curve rises rapidly and then flattens, eventually reaching a theoretical

maximum: for Africa, 192 Gbo. But the time and cost of exploration impose

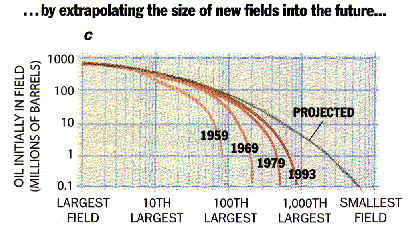

a more practical limit of perhaps 165 Gbo (b). Third, we analyzed

the distribution of oil-field sizes in the Gulf of Mexico and other

provinces. Ranked according to size and then graphed on a logarithmic

scale, the fields tend to fall along a parabola that grows predictably

over time (c). (Interestingly, galaxies, urban populations and

other natural agglomerations also seem to fall along such parabolas.)

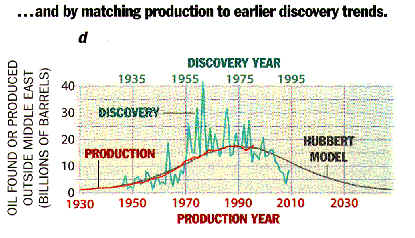

Finally, we checked our estimates by matching our projections for oil

production in large areas, such as the world outside the Persian Gulf

region, to the rise and fall of oil discovery in those places decades

earlier (d).

-C.J.C. and J.H.L

|

|

|

|

The Authors

COLIN J. CAMPBELL and JEAN H. LAHERRÈRE have each worked in the oil industry for more than 40 years. After completing his Ph.D. in geology at the University of Oxford, Campbell worked for Texaco as an exploration geologist and then at Amoco as chief geologist for Ecuador. His decade-long study of global oil-production trends has led to two books and numerous papers. Laherrère’s early work on seismic refraction surveys contributed to the discovery of Africa’s largest oil field. At Total, a French oil company, he supervised exploration techniques worldwide. Both Campbell and Laherrère are currently associated with Petroconsultants in Geneva.

Further Reading

Updated Hubbert Curves Analyze World Oil Supply. L. F Ivanhoe in World Oil, Vol. 217, No. 11, pages 91-94; November 1996.

The Coming Oil Crisis. Colin J. Campbell. Multi-Science Publishing and Petroconsultants, Brentwood, England, 1997.

Oil Back on the Global Agenda. Craig Bond Hatfield in Nature, Vol. 387, page 121; May 8,1997.